Standard Negative Gearing Calculator

All the Standard Negative Gearing Calculators has the ability to estimate National Rental Affordability Scheme (NRAS) investment property.

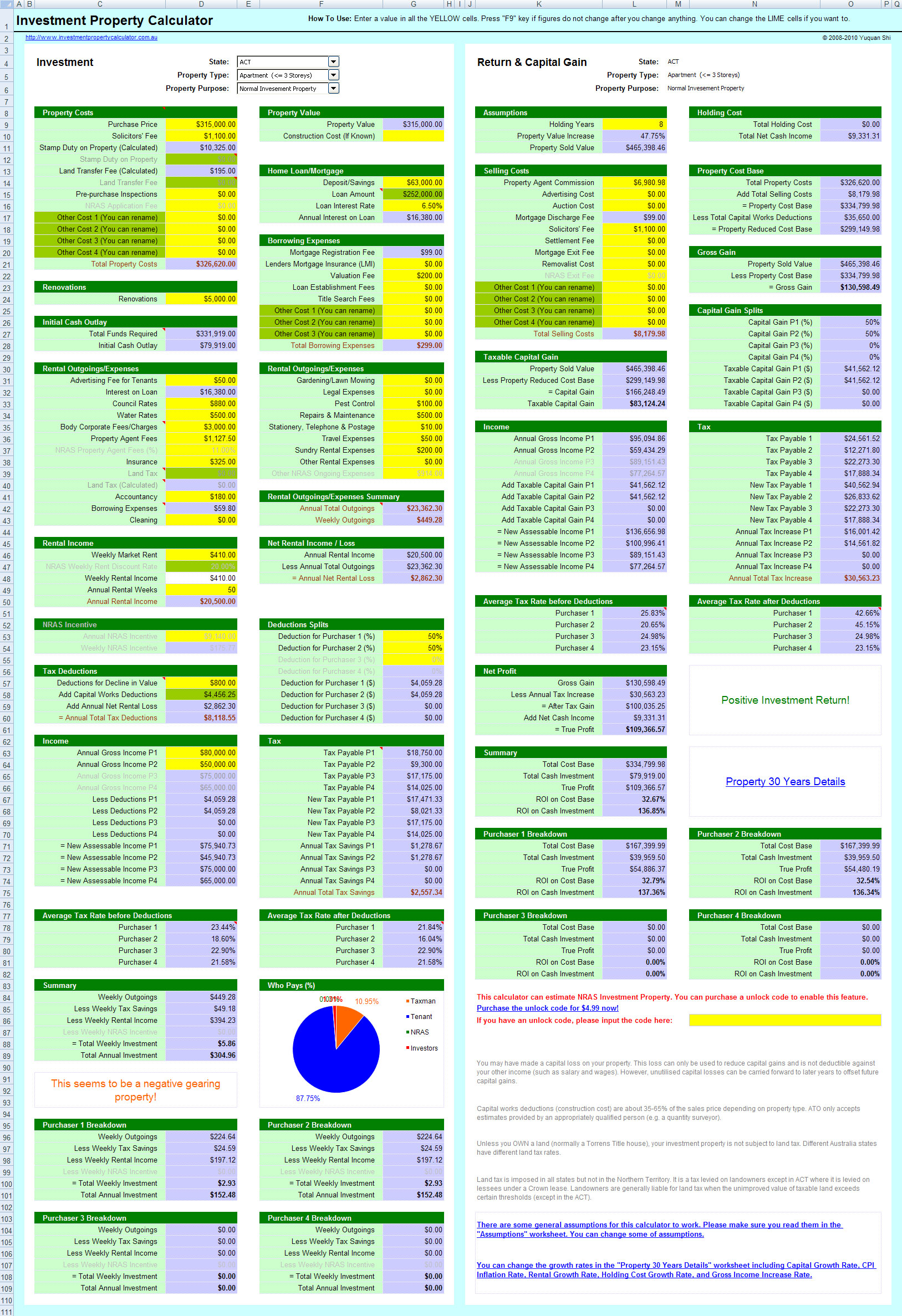

Here is a screen shot that will give you a better idea that what you need to do and what this standard property calculator can tell you.

View full size image of Standard Negative Gearing Calculator

This Standard Negative Gearing Calculator give you much more information on costs etc that the Free version does not.

1. It allows you to simulate up to four people to co-invest on one property. It also shows the weekly cost and the future ROI for each individual investor.

2. It predicts up to 30 years cash flow of both pre-tax and after-tax.

3. It estimates property market value for future 30 years based on the capital growth rate that you set.

4. It calculates who pays for your investment property and how much on a weekly basis - from year 1 to year 30.

5. It automatically calculates the income tax before and after deductions.

6. It automatically populates all the government tax, duties, and the capital works deductions (construction cost depreciation).

7. It will clearly tell you whether the investment property you want to purchase is a negative gearing one or a positive cashflow property.

The limitations compared with the Professional Negative Gearing Calculator include the standard one does not allow you to compare across different states. For example, if you want to know whether you should invest in NSW or QLD, you should use the Professional Negative Gearing Calculator.

Things You Need to Know

Please note: All the Negative Gearing Calculators (Free version, Standard version, Professional version, or Ultimate version) have the same set of following assumptions.

(1) It is assumed the investor has an interest only (unless otherwise stated) home loan and the interest is deductible for tax purposes.

(2) When calculating the Capital Works Deductions, it assumes that the construction of the property started after 15 September 1987 and therefore the depreciation deduction is claimed for 40 years from the date construction was completed at a rate of 2.5% per year. Please note: You can manually adjust the depreciation deduction values from year to year if this assumption does not suit your situation.

(3) When calculating the tax payables, the tax rates applicable to Australian residents are used and the 1.5% Medicare Levy based on the individual Medicare Levy threshold is included where applicable. The calculator does not incorporate any other factors that might influence the amount of tax payable, such as Medicare levy surcharge, HECS contributions, any rebates, and deductions.

(4) The discount method is used to calculate capital gain tax if you hold the property for at least 12 months. The discount percentage is 50%.

(5) All months are assumed to be of equal length. One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.

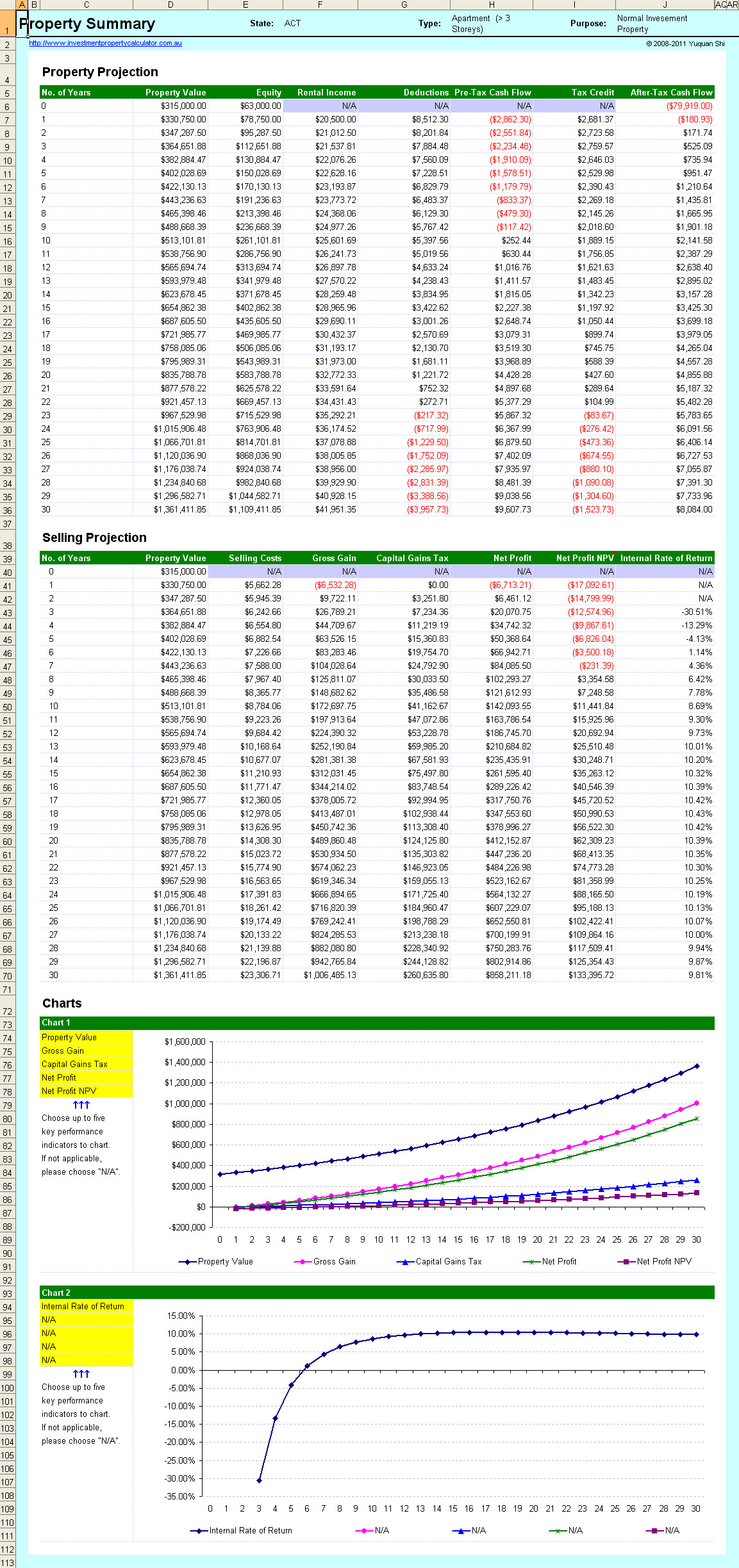

Screenshots of Standard Negative Gearing Calculator

View full size image of Standard Negative Gearing Calculator - 30 Years Summary

View full size image of Standard Negative Gearing Calculator - Property 30 Years Details

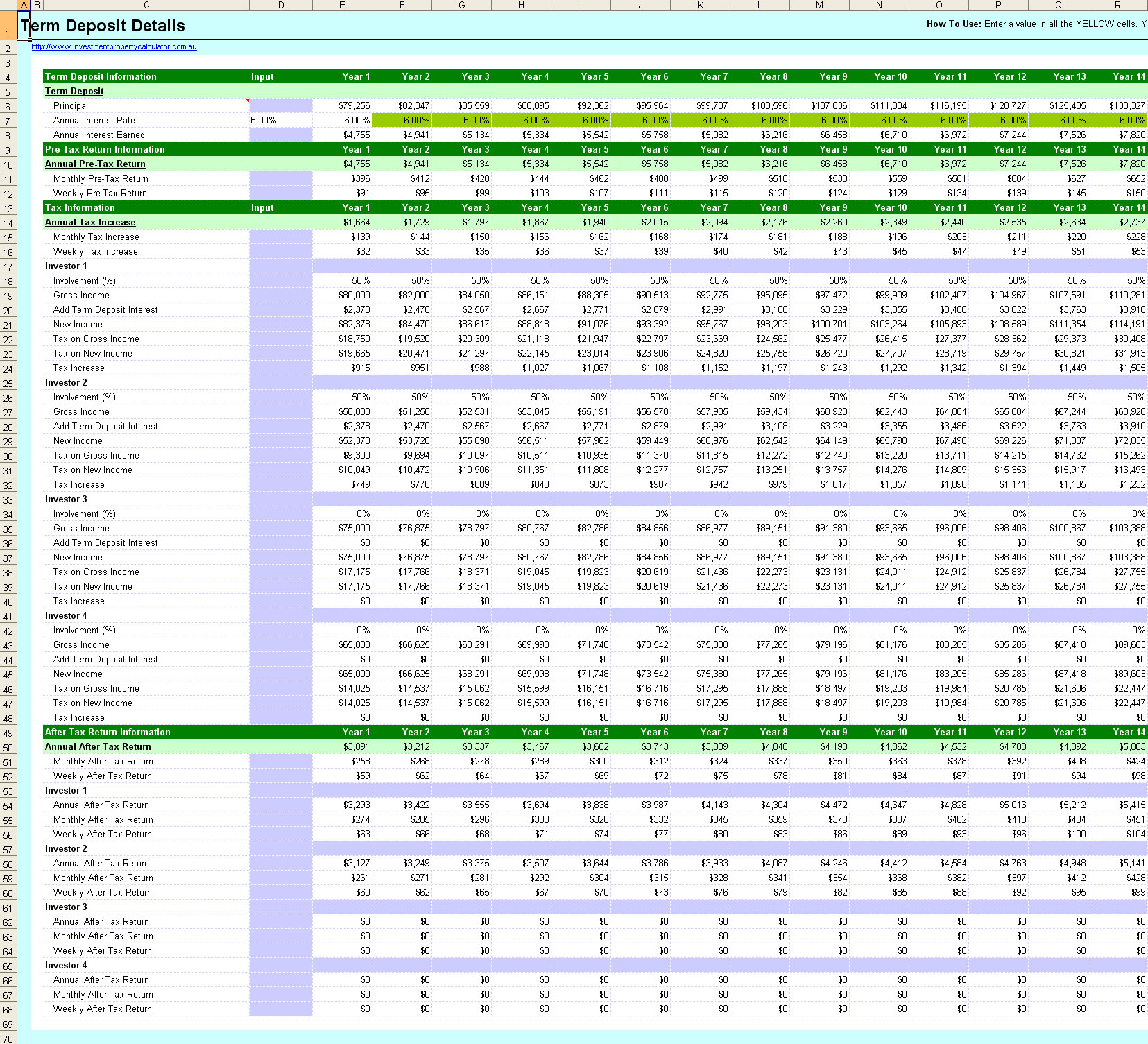

View full size image of Standard Negative Gearing Calculator - Term Deposit

Refund Policy: If you are having issues with a product and need assistance with downloading and/or using the product, please contact us before you ask for a refund as we are confident that we will be able to resolve the issues. If we cannot help you, full refund will be offered within 30 days from the date of purchase. Negative Gearing Calculator will do our best to satisfy all refund requests from customers in a courteous, timely, and fair manner. Again, it will be very much appreciated if you can let us to rectify any issues you are having before asking for a refund.

Buy Negative Gearing Calculator

The Calculator will be sent to you via email.

Cost - Personal Use: $59

Cost - Commercial Use: $119

File Type

.xlsb - Excel Spreadsheet

Version

Standard version - v1.0.2024

Professional version - v1.0.2024

Ultimate version - v1.0.2024

File Size

Standard version - ~440KB

Professional version - ~560KB

Ultimate version - ~9,070KB

Required

Microsoft Excel® 2007 & above for Microsoft Windows®

OR

Microsoft Excel 2011 & above for Mac

Support

Please use the Contact Form if you have questions.